The way land and property prices are increasing, normal houses are no longer feasible for many people. And a popular alternative they look for nowadays is mobile homes. However, mobile homes still aren’t cheap. It costs quite a bit of money, and many people still struggle to get the down payment – and that’s where loans and credit scores come in.

So, what does it mean?

What Does a Credit Score Represent?

A credit score is calculated based on your credit history, which is a record of your borrowing and repayment activity. The information in your credit history is used to generate a credit score, which is a number that advocates your creditworthiness. Lenders use credit scores to decide whether you are a good candidate for a loan and what interest rate they will charge you.

A high credit score entails you are a low-risk borrower, which leads to a smaller interest percentage on a loan. A low credit score could lead to a higher interest rate and could mean you will not be approved for a loan at all.

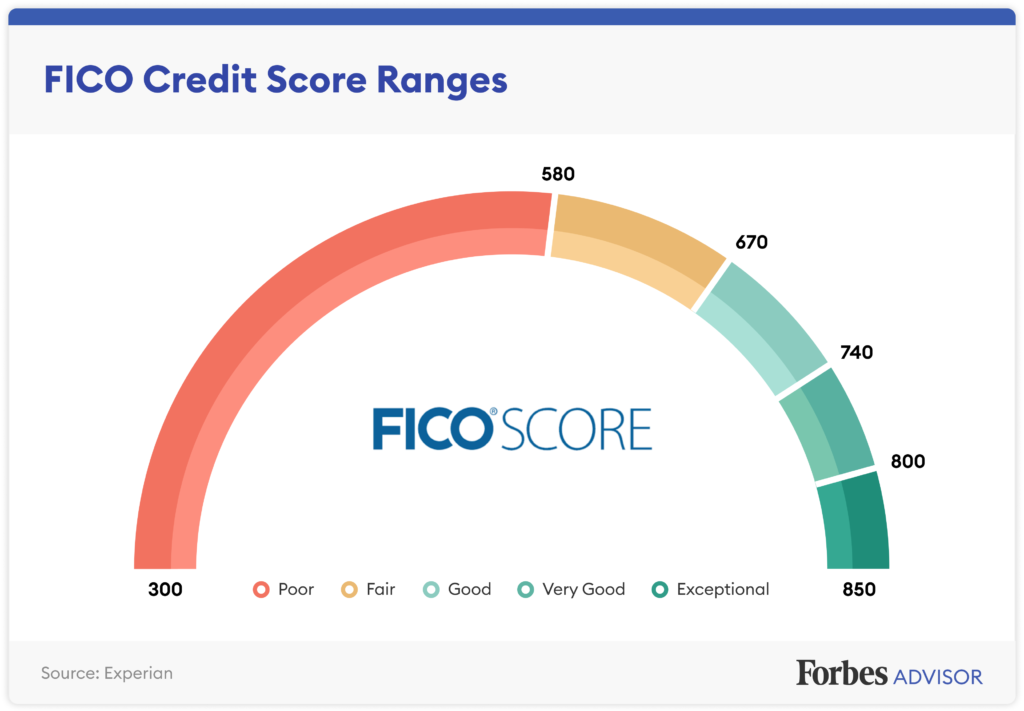

There are some other credit scoring models, but the most common one is the FICO score. The FICO scale ranges from 300 to 850; the higher your score, the better. A score of 800 or more is considered excellent, while a score of 740 to 799 is seen as good. A score of 670 to 739 is considered fair, while a score of 580 to 669 is considered poor. A score of below 580 is considered very poor.

Credit Score Requirements

What is the minimum credit score for a mortgage loan? That largely depends on the type of mortgage you want. If you want the lowest mortgage interest rate, you’ll need a stellar credit score of 740 or higher.

With a score below that, you’ll still be approved for some loans but will receive less favorable loan terms.

For instance, you may be approved for an FHA loan with a score as low as 580. But your interest rate will be significantly higher than someone with a score of 740.

The minimum credit score for a conventional mortgage is 620. But if you want the lowest possible down payment, you may need a score of at least 720.

The bottom line is that the higher your credit score, the better your chance of getting a low mortgage rate. So if you’re planning on buying a mobile home, make sure you do everything you can to raise your score before you apply for a loan.

How to Finance Your Mobile Home

FHA Loans

FHA loans can finance mobile homes, and this program offers several advantages. The most significant advantage is that these loans are available to people with less-than-perfect credit. In addition, the down payment requirements are much lower than other types of home loans.

The minimum down payment for an FHA loan is 3.5%. The maximum loan amount is typically 96.5% of the home’s purchase price.

To get an FHA loan, the borrower must first find a lender approved by the FHA to make these types of loans. The borrower then must fill out an application and provide the lender with all the necessary documentation. Once the loan is approved, the borrower must pay a loan origination fee and closing costs.

VA Loans

The Department of Veterans Affairs (VA) offers a variety of benefits to help service members, veterans, and their families access the services and support they need. One of these benefits is the VA Loan, which can be used to finance the purchase of a mobile home with all ranges of credit scores.

VA Loans are available through private lenders, such as banks and mortgage companies, and are guaranteed by the VA. This guarantee protects the lender against loss if the borrower defaults on the loan.

To be eligible for a VA Loan, the borrower must be a veteran, service member, or surviving spouse. The borrower must also meet the credit score and income requirements set by the lender.

Once the borrower is approved for a VA Loan, they will need to find a mobile home that meets the VA’s minimum property requirements. The home must also be located in a VA-approved community.

Wrapping It Up

Why be tied down? Get yourself a mobile home at a much more affordable price than conventional houses. And attaining that dream mobile home will be much easier with a proper credit score.